Most Companies have a Class/Category for Administrative Overhead that can’t be easily costed to Operating Centers. Because Administrative Costs are real (if each operation were a stand-alone business, they would have to hire resources like payroll, IT, Salesmen, and Management).

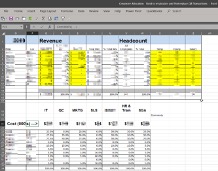

We can use a Corporate Allocation Tool to allocate that bucket of costs to each Operation. We usually do that once a year during the budgeting process. Revenue and Headcount are typically the best indicators of use of Administrative Services.

An additional strategy we use in this area involves a strategy I call “Vertical and Horizontal Costs” combined with a chart of accounts that has been tuned to the way you manage your business. What the heck does that mean?

Example: Our Chart of Accounts might have a master EXPENSE account for “IT” (No bills are posted there, it is a “Header” only) with a Sub-Account “Computers” (We have an IT manager who is responsible for budgeting across the organization for all “IT” accounts). If the IT Manager buys a server for an Operating Division, it is coded “Horizontally” to the “Computers” Account – Period! Going further, if they buy it for and Operating Divisions, it is coded the that Divisions CLASS/Center. However, If they buy it for a service that benefits the entire company, it would be coded Vertically to the IT CLASS/Center.

Example: Our Chart of Accounts might have a master EXPENSE account for “IT” (No bills are posted there, it is a “Header” only) with a Sub-Account “Computers” (We have an IT manager who is responsible for budgeting across the organization for all “IT” accounts). If the IT Manager buys a server for an Operating Division, it is coded “Horizontally” to the “Computers” Account – Period! Going further, if they buy it for and Operating Divisions, it is coded the that Divisions CLASS/Center. However, If they buy it for a service that benefits the entire company, it would be coded Vertically to the IT CLASS/Center.

At the end of the period, Each CLASS/Center would receive a %age of that cost based on the Budgeted Corporate Allocation %ages. This saves the accounting department from splitting Vendor Bills at the time they are processed. Instead, Accounting makes one journal entry at the end of the month to allocate all vertical IT Expenses.

So why the need to discuss Vertical and Horizontal? Great Question! Because we took the time to 1) set up our Chart of Accounts in alignment with the way we manage our business and 2) Have accounting Code costs vertically (rather than try to split them up) and 3) Took the time to calculate and record Corporate Allocations, we can now have our IT Manager budget for Vertical and Horizontal Costs annually AND get monthly Comparative P&L’s for Vertical and Horizontal Costs.

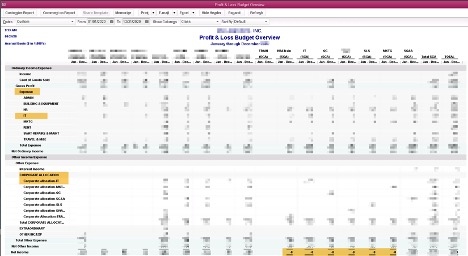

Ohhh! You begin to see the power of this method. Now, we can hold the IT Manger responsible – a Results Owner — for managing Vertical and Horizontal Costs across the organization. And, we have reasonably allocated Corporate Costs to Operating Units so we can see a truer picture of their Operating Income. It could look something like what you see below. Notice IT shows up as two-line items. Once under EXPENSE (Vertical) and one under Corporate Allocation (Horizontal) – but both have costs in each operation. Also note the IT (and other SGA CLASSes) columns net to Zero – they have all been allocated!

If you’re looking for tools and training on how to set up and report Corporate Allocations so you can get a handle on the actual Profit each Operation is generating, click the contact us link here to get started. Don’t wait to get started on understanding the true profit your Operations are realizing.

About the Author

Dave Creasey, owner of FRM, has a passion for helping business maximize their profitability. Dave's motto is simple: "What gets measured, gets done." And with over 30 years experience as a CFO, Controller, Big 4 Auditor and Owner, Dave has developed the tools business owners need to reach their goals.

Browse More Blogs

contact

Fill out the contact form below to help me learn more about your company and the services you might be interested in.

Recent Comments